This comprehensive guide provides detailed insights and preparation strategies for the Georgia insurance license exam, ensuring candidates are well-versed in state-specific regulations and national standards.

Overview of the Exam and Its Importance

The Georgia insurance license exam is a critical step for individuals seeking to enter the insurance industry. It assesses knowledge of both national and state-specific regulations, ensuring professionals are well-informed. The exam covers essential topics like insurance laws, ethics, and product types, such as life, health, and property insurance. Passing the exam demonstrates competence and commitment to ethical practices, which are vital for building trust with clients. Proper preparation is key to success, and utilizing study guides, practice exams, and flashcards can significantly improve readiness. Understanding the exam’s structure and content is the first step toward achieving licensure and advancing your career in insurance.

How to Use the Study Guide Effectively

Maximize your preparation for the Georgia insurance license exam by systematically using the study guide. Begin by reviewing each chapter thoroughly, focusing on key topics like insurance regulations and product types. Utilize the provided flashcards to memorize important terms and concepts. Practice with sample exams to familiarize yourself with the test format and time management. Pay attention to areas where you score low and revisit those sections. Supplement your studying with online resources and tutorials for additional support. Consistent review and active engagement with the material will enhance your understanding and confidence, ensuring you are fully prepared for the exam.

Pre-Licensing Education Requirements

Complete a state-approved prelicensing course to qualify for the Georgia insurance exam, ensuring you meet all educational prerequisites before applying for your license.

State-Specific Requirements for Georgia

Georgia requires candidates to complete a state-approved prelicensing education course before taking the insurance license exam. This typically includes 20 hours of general insurance concepts and 12 hours of state-specific content. The course must cover Georgia insurance laws, regulations, and ethics, ensuring candidates understand the unique requirements of the state. Upon completion, candidates receive a certificate, which is valid for one year and must be submitted when applying for the license. It is essential to ensure the course is approved by the Georgia Insurance Commissioner to meet all state-specific prerequisites. Understanding both national and Georgia-specific content is crucial for exam success.

Approved Course Providers and Study Materials

Kaplan is a prominent provider of Georgia insurance license exam study materials, offering comprehensive courses and resources. Their study guide, including the 2014 manual and the Georgia Insurance Department supplement, is designed to cover both national and state-specific requirements. Courses are available in online and hard copy formats, with chapter materials also accessible in PDF when the book isn’t available. It’s crucial to ensure that any chosen course is state-approved to meet Georgia’s prelicensing education requirements. These materials help candidates prepare effectively, covering essential topics and ensuring readiness for the exam.

Understanding the Exam Format

The Georgia insurance license exam includes multiple-choice questions covering state-specific regulations and national insurance standards, requiring a strong understanding of both to achieve success.

Types of Questions and Exam Structure

The Georgia insurance license exam features multiple-choice questions designed to test knowledge of both national and state-specific insurance principles. The exam structure includes questions on insurance regulations, ethics, and various insurance types, such as life, health, and property. Candidates must demonstrate a clear understanding of key concepts and legal requirements. The questions are balanced to assess both theoretical knowledge and practical application. Proper time management is essential, as the exam is timed, and candidates must carefully review each question to ensure accurate responses. Understanding the question format and content distribution is crucial for effective preparation and success.

Time Management and Test-Taking Strategies

Effective time management is crucial for success on the Georgia insurance license exam. Candidates should allocate their time wisely, skimming through questions to identify easier ones first and returning to more challenging topics later. Utilize process-of-elimination techniques to narrow down answer choices, increasing the likelihood of selecting the correct response. Practice exams and flashcards can help refine these strategies and improve pacing. Prioritize understanding the question format and content distribution to avoid wasting time during the exam. By mastering these test-taking strategies, candidates can approach the exam with confidence and maximize their chances of achieving a passing score.

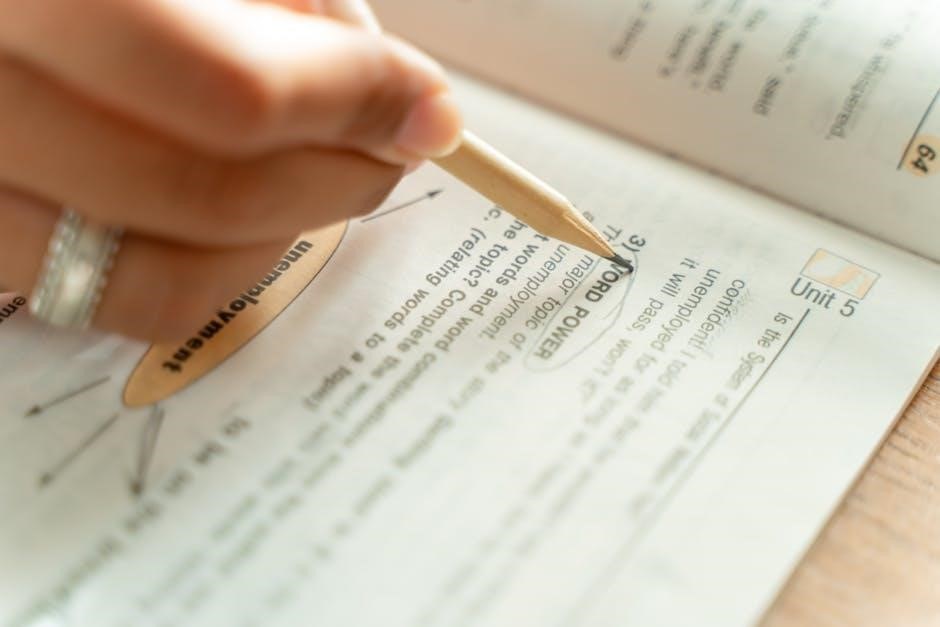

Key Topics Covered in the Study Guide

The study guide covers essential topics, including insurance regulations, ethics, and core concepts like life, health, and property insurance, ensuring a comprehensive understanding for exam success.

Insurance Regulations and Ethics

Understanding insurance regulations and ethics is crucial for exam success. The study guide covers key topics such as compliance with state and federal laws, fiduciary responsibilities, and consumer protection. It also delves into the role of the Georgia Insurance Commissioner, emphasizing ethical practices and professional standards. Candidates will gain insights into how regulatory bodies enforce laws and the consequences of non-compliance; The guide provides real-world examples and case studies to illustrate ethical dilemmas and their resolutions. Mastering these concepts ensures a strong foundation in legal and ethical practices, essential for both the exam and a successful career in the insurance industry.

Life, Health, and Property Insurance Concepts

The study guide delves into fundamental concepts of life, health, and property insurance; It explores types of life insurance policies, such as whole life and term life, and their benefits. Health insurance basics, including group and individual plans, are also covered. Property insurance concepts focus on homeowners’ and auto insurance, emphasizing key terms like deductibles and coverage limits. The guide explains policy provisions, underwriting principles, and risk management strategies. Candidates learn how to differentiate between various insurance products and understand their applications. This section provides a clear understanding of core insurance principles, essential for both the exam and real-world application in the industry.

Georgia-Specific Insurance Laws and Regulations

Georgia-specific insurance laws and regulations are crucial for licensing. The guide covers state-specific requirements, including insurance types, compliance standards, and legal frameworks. It ensures comprehensive preparation for the exam.

Powers and Duties of the Insurance Commissioner

The Georgia Insurance Commissioner oversees the state’s insurance industry, ensuring compliance with laws and regulations. Key duties include licensing insurance companies, approving policy forms, and protecting consumer rights. The Commissioner also investigates complaints, enforces ethical standards, and monitors financial stability of insurers. Understanding these roles is essential for exam preparation, as they are frequently tested. The study guide highlights the Commissioner’s authority in regulating agents, brokers, and adjusters, as well as their responsibility to educate the public on insurance matters. This section provides in-depth insights into the Commissioner’s powers, helping candidates grasp their significance in Georgia’s insurance framework.

License Requirements and Renewal Processes

Obtaining a Georgia insurance license requires completing pre-licensing education and passing the state exam. A valid life insurance license or exam score is necessary. Renewal involves continuing education and periodic updates. Understanding both national and state-specific guidelines is crucial for maintaining certification. The study guide outlines these processes, ensuring compliance with Georgia’s regulations. Resources like flashcards and practice exams aid preparation. Regular updates keep professionals informed of industry changes, ensuring ongoing competency and adherence to legal standards.

Study Tips and Resources

Utilize active learning techniques like creating concept maps and self-testing. Join study groups and leverage mobile apps for on-the-go preparation. Consistent review and organized materials are key to success.

Utilizing Flashcards and Practice Exams

Flashcards are an excellent tool for memorizing key insurance terms and concepts, while practice exams simulate real test conditions, helping you assess your readiness. Kaplan’s resources include flashcards with definitions and concepts, such as variable annuities and producer responsibilities. Practice exams provide a realistic experience, allowing you to identify weak areas and improve time management. Use these tools consistently to reinforce learning and build confidence. Additionally, mobile apps enable on-the-go study, making it easier to prepare anytime. Regularly simulating exam scenarios ensures you’re familiar with the format and content, reducing anxiety and enhancing performance on exam day.

Accessing Free Study Materials and Tutorials

Free study materials and tutorials are essential for effective preparation. Platforms like Quizlet offer flashcards with key terms and concepts, such as variable annuities and producer responsibilities. Kaplan provides free samples of their study tools, including flashcards and practice exam demos. Additionally, many websites offer free PDF study guides and tutorials that cover Georgia-specific insurance laws and regulations. Online forums and study groups also provide valuable resources and tips from experienced professionals. Utilizing these free materials helps candidates stay updated on exam content and strategies without additional costs. These resources are easily accessible and can be used alongside paid materials for comprehensive preparation.